Investment Commentary –August 17th, 2022

Year to Date Market Indices as of August 17th, 2022

• Dow 34,118 (-5.92%)

• S&P 4,307 (-9.96%)

• NASDAQ 13,658 (-17.22%)

• OIL $86.38 (14.57%)

• Barclay Bond Aggregate (–9.62%)

STOCK MARKET NEWS: Walmart, Home Depot lift Dow, housing hit again, oil below $90

Solid results and forecasts from Walmart and Home Depot contributed to a 239+ point gain for the Dow Jones Industrial Average while also lifting the S&P’s consumer discretionary names. The tech-heavy Nasdaq Composite registered a slight drop as Apple and Facebook slipped. In commodities, oil fell over 3% to $86.53 per barrel, the lowest level since January.

US manufacturing production accelerates in July

Production at U.S. factories increased more than expected in July as output rose at motor vehicle plants and elsewhere, pointing to underlying strength in manufacturing despite ebbing business confidence.

Manufacturing output rebounded 0.7% last month after declining 0.4% in June, the Federal Reserve said on Tuesday. Economists polled by Reuters had forecast factory production would rise 0.2%. Output increased 3.2% compared to July 2021.

Manufacturing, which accounts for 11.9% of the U.S. economy, remains supported by strong demand for goods even as spending is gradually shifting back to services. But risks are rising, with retailers sitting on excess inventory, especially of apparel.

Production at auto plants surged 6.6% last month. Excluding motor vehicles, manufacturing rose 0.3%. Output of long-lasting manufactured consumer goods increased 3.5%, while that of nondurable consumer goods fell 0.3%.

Around the Web

Four in a row: The major U.S. stock indexes each posted returns exceeding 3% as investors welcomed indications of a modest easing in inflation. For the S&P 500 and the NASDAQ, it was the fourth positive result in a row the longest string of weekly gains since November 2021.

Inflation moderation: Although U.S. inflation remains near its highest level since the early 1980s, the latest monthly Consumer Price Index report brought some relief, which triggered a stock market rally on Wednesday. Inflation rose at an annual 8.5% rate in July, marking a slowdown from the previous month’s 9.1% figure. Falling gasoline prices were largely responsible for the decline.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

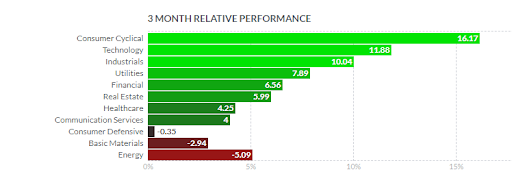

https://finviz.com/groups.ashx (YTD Performance Chart)

https://finviz.com/groups.ashx

https://www.foxbusiness.com/live-news/stock-market-today-8-16-2022?dicbo=v2-c382b581ca07e64485a9215588ae63d7