Investment Commentary – June 12, 2024

Year to Date Market Indices as of June 12, 2024

• Dow 38,845 (3.08%)

• S&P 5,434 (14.01%)

• NASDAQ 17,655 (17.67%)

• OIL $78.07 (9.46%)

• Barclay Bond Aggregate (-0.9%)

• Gold $2,351(13.54%)

PERSONAL FINANCE

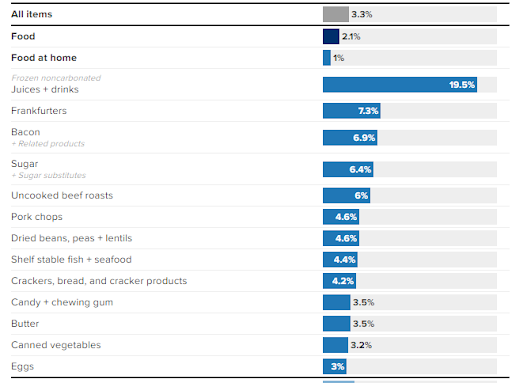

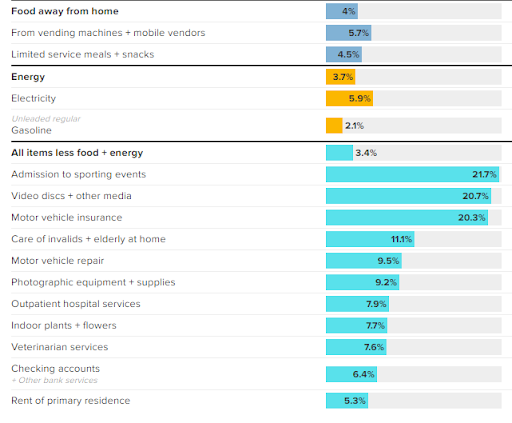

- Here’s the inflation breakdown for May 2024 — in one chart.

- Inflation pulled back in May 2024. The consumer price index declined to a 3.3% annual rate, down from 3.4% in April.

- Prices have eased for consumer staples like gasoline and groceries. Housing inflation has been stubbornly high, though is falling slowly.

- The CPI data is likely welcome news for Federal Reserve officials, who may see it as evidence they can soon cut interest rates.

Food and gasoline inflation fell

While annual data on inflation trends are helpful, economists generally recommend looking at monthly numbers as a better guide of short-term movements and inflation trends.

The monthly reading was unchanged, at 0% in May, down from 0.3% in April and 0.4% in March. (To get back to target, economists say the monthly reading should consistently be in the range of about 0.2%.)

That downward move was “largely driven” by lower gasoline prices, said Joe Seydl, senior markets economist at J.P. Morgan Private Bank.

‘Encouraging’ news for interest rates

The CPI gauges how fast prices are changing across the U.S. economy. It measures everything from fruits and vegetables to haircuts, concert tickets and household appliances.

The April inflation reading is down significantly from its 9.1% pandemic-era peak in 2022, which was the highest level since 1981. However, it remains above policymakers’ long-term target, around 2%.

Market News

Labor market resilience

May’s jobs growth figure of 272,000 came in well above most economists’ forecasts for around 180,000 and wage growth also exceeded expectations, further complicating the outlook for a potential interest-rate cut this year. Government bond yields rose following Friday morning’s report and stocks were little changed.

Europe’s rate cut lead

As the U.S. Federal Reserve considers whether to begin cutting interest rates later this year, the European Central Bank approved its first such reduction since 2019. Policymakers cited recent progress in reducing inflationary pressures as they approved a quarter-point rate cut affecting the 20 countries that use the euro currency.

Slippery oil

The price of U.S. crude oil fell below $73 per barrel on Tuesday to its lowest level in four months after a consortium of oil-producing countries announced plans for a more gradual phase-out of production cuts. The price recovered somewhat to more than $75 per barrel on Friday, but it was still well below a recent high of nearly $88 in early April.

https://www.marketwatch.com/ (Market Indices)

https://www.jhinvestments.com/weekly-market-recap#market-moving-news

https://www.cnbc.com/2024/06/12/cpi-inflation-may-2024-in-one-chart.html

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.