Happy Monday August 24, 2020. I don’t know about you, but I am ready for 2020 to be over. Or simply, I’m ready for the old norm to return. I don’t think the old normal will be the new normal again for some time. I rarely go anywhere these days and when I do, I’m that guy you see walking back out to the car to get my mask as I forget to grab it. After 6 months of this, it’s just not a habit for me yet and in part, my new routine and lack of going places doesn’t help me remember my mask. Time will tell what the new normal will look like.

I listened to a great podcast last week from an Economist saying the Coronavirus is here to stay for several years, citing 4-5 years. Just because we may get a vaccine, the virus itself won’t just go away. The vaccine may help to save lives. Then, hopefully there may be a preventative coronavirus shot like the flu shot. Time will tell on this as well. This made me think, are masks going to be our new normal? And if so, for how long???

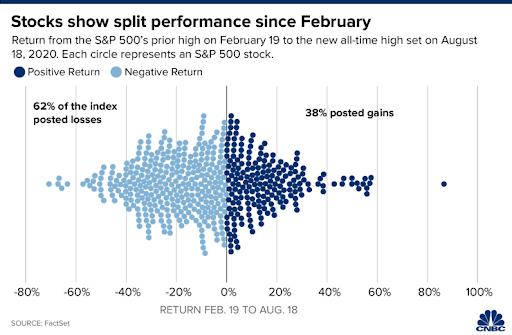

Referencing back to Monday July 27th email. In this email I got a bit “nerdy” and cited numbers regarding the S&P500 and the connection of the 6 FAANGM stocks (Facebook, Apple, Amazon, Netflix, Google, Microsoft). See in Tid Bits below new updated numbers on the S&P500 and how 62% of those 500 stocks are still reporting losses. The FAANGM (FANG is what its called) stock are still warping the numbers.

Performance DJIA:

Mon 8/17 -0.31%

Tues 8/18 -0.24%

Wed 8/19 -0.31%

Thurs 8/20 +0.17%

Fri 8/21 +0.69%

Last week 0.00% (yes that is correct)

Since 2/19 market high -4.83%

Bond model you are in:

Last week +0.19%

Comparison:

Bond model last 30 days +0.67%

Tid Bits:

The S&P 500′s return to a record doesn’t tell the full story with 60% of stocks still with losses

- Though the S&P 500 has hit a new all-time high and wiped out losses from the coronavirus sell-off, a CNBC analysis shows that the majority of stocks have yet to climb back to their prior levels.

- Between the prior market high on Feb. 19 and new high on Aug. 18, 38% of stocks in the index made gains while the remaining 62% posted losses.

- Performance varied by sector, with more than 50% of stocks in the consumer staples, health care, and information technology sectors showing gains. That figure is less than 10% for energy and utilities stocks.

- The S&P 500 closed at a record high on Tuesday, wiping out losses from the coronavirus-induced sell-off and returning the market to pre-pandemic levels.

- But while the index is right back where it started before the virus sent the market plunging, a CNBC analysis shows that the majority of stocks have yet to climb back to their prior levels. While the overall market crashed and then reached new heights between its previous high on Feb. 19 and new high on Aug. 18, only 38% of stocks in the index made gains over that time period. A majority, the remaining 62%, were negative.

- In an interview on CNBC following Tuesday’s record close, Michael Yoshikami, CEO of Destination Wealth Management: “It’s not as if everything is rising,” he said. “You pull money out of names that really aren’t attractive given current conditions. And that money moves over to companies that are thriving in this environment.”

Trump announces emergency authorization of ‘breakthrough’ coronavirus treatment

- President Trump on Sunday granted an emergency authorization for the usage of convalescent plasma to treat coronavirus patients, dubbing it a “major breakthrough.”

- Speaking to reporters from the White House Sunday, Trump said the FDA has “issued an emergency use authorization… for a treatment known as convalescent plasma.”

- This is a powerful therapy that transfuses very very strong antibodies from the blood of recovered patients to help treat patients battling a current infection,” Trump said, adding that the authorization will “expand access to this treatment.”

- More than 64,000 patients in the U.S. have been given convalescent plasma, a century-old approach to fend off flu and measles before vaccines. It’s a go-to tactic when new diseases come along, and history suggests it works against some, but not all, infections.

- There’s no solid evidence yet that it fights the coronavirus and, if so, how best to use it. The FDA, in announcing the emergency authorization for convalescent plasma said its benefits “outweigh the known and potential risks of the product and that there are no adequate, approved, and available alternative treatments.”

Facts:

Coronavirus

Global 23,618,607 cases 813,112 deaths

US 5,875,254 cases 180,614 deaths (+4.32%, +7,475 increase from last week)

KS 37,489 cases 429 deaths

MO 75,381 cases 1,540 deaths

Highlights from analysts and economics

From Invesco

Coronavirus has upended the traditional cadence of an American presidential election year. 2020 is still an election year, however, and the campaigns will go on. While the election will have a momentous impact on the country, one area where we caution investors from drawing too many links to is the world of investing.

Our 9 truths no matter who wins:

- Markets have performed well under both parties.

- We do not radically re-engineer the US economy.

- The historical narrative is not as you remember it.

- Signature legislative accomplishments are infrequent, and the impact is not always as expected.

- Predictions tend to be wrong.

- Monetary policy matters more.

- It’s okay if you don’t like the President. The market doesn’t care.

- No, this is not the most vitriolic election.

- Don’t confuse partisan politics with market analysis and keep your eye on one indicator.

From MNY Mellon

Highlights from our Global Economics and Investment Analysis Group’s new commentary:

- Global stocks gained 5.3% in July bringing the YTD loss to only -1.0%.

- Risk-on sentiment continues to be aided by massive stimulus; expectations policy will remain easy for the foreseeable future, a softer USD, and overall improvement in economic activity.

- Despite this improvement, there are increasing signs the pace of recovery is slowing, particularly in the US, as resurgence in Covid-19 cases restricted economic re-openings and lowered consumer confidence.

- In fixed income, spreads tightened and yields moved lower with the US 10-year Treasury falling 13 bp to a new all-time low.

- The USD suffered its worst monthly performance in a decade as gold reached new highs.

- Risks remain skewed to the downside especially if the labor market recovery stalls.

From FS Investments

The dog days of summer are upon us. While August has historically brought volatility to markets, equities in 2020 appear to have shrugged off their typical late-summer doldrums, posting solid gains to start the month. However, some warning signs are flashing of possible bumps ahead. In this note we discuss what the options market is telling us about potential volatility in the coming months – and what investors can do now to prepare.

Historically, August has been a tough month for stocks. The average S&P 500 return in August over the past 15 years is -0.17%, and these meager returns are often accompanied by an increase in volatility. But equities have looked tame lately, with 1 month realized volatility clocking in at just 10.2%, and the average daily move of the S&P 500 over that time period has been just 30 basis points. This market would feel extremely placid even under normal economic circumstances, let alone our current macro backdrop.

Markets are just a few months removed from the acute pain many experienced during March’s sell-off, when realized volatility reached 92%. As markets have recovered in extraordinary fashion, volatility has receded. But year to date realized volatility remains high from a historical context, at 41.35%, whereas long-term averages are in the mid-teens. With headline risks extreme – a pandemic, a looming U.S. presidential election and geopolitical tensions, to name a few – markets feel downright complacent. The dichotomy between implied and realized volatility measures would agree, as these signals in options markets are pointing toward heightened volatility ahead.

From Nuveen

The economic recovery is continuing, but we expect it will be bumpier than what than what equity markets reflect.

Stocks have been moving higher thanks to momentum, supportive policy and improving sentiment. But we are growing concerned that investors may be overlooking some key risks.

With valuations appearing full, we expect markets could be in for a period of consolidation or a corrective phase.

From JP Morgan

The Human Implications of the Washington Stalemate

The title of these weekly articles often starts with, “The Investment Implications of…..”

This is usually appropriate since almost all big issues have investment implications and the focus of these articles has always been to see the investment environment with clarity.

Sometimes, however, it must be acknowledged that the investment implications of an issue are far less important than its other impacts. This has been the case throughout this blighted, pandemic year and is particularly true of the stalled talks in Washington on the issue of further coronavirus relief.

Thus far, financial market reactions to this have been muted. However, a continuation of this political standoff could worsen the economic toll of the pandemic, result in further unnecessary illness and death, and further erode both the functioning of the democratic process and the trust Americans place in it. Indirectly, of course, all of this has impacts on financial markets also. However, to see them, it is important to first appreciate the human implications of the Washington stalemate.

The most obvious problem is the distress that will increasingly be felt by workers laid off in the pandemic.

Between February and April, the U.S. lost 22.2 million jobs and has since regained 9.3 million or 42% of those jobs. However, the initial job losses hit the lowest-paid workers the hardest and their jobs have seen the slowest rebound. As evidence of this:

- Between February and July, employment fell by 13.5% for those with a high-school diploma compared to just 1.7% for those with a 4-year college degree.

- Production and non-supervisory workers account for about 70% of total payroll employment. However, they have experienced 85% of the job losses in the pandemic.

- We estimate that the prior average weekly paycheck for laid-off production and non-supervisory workers was $693 compared to $820 for those not laid off.

A second problem with no further coronavirus relief concerns efforts to control the pandemic itself. Since late July, the seven-day moving average of new confirmed cases has fallen back from 65,000 to just over 50,000. However, this is still resulting in a grim death toll of roughly 1,000 per day.

Finally, there is the question of the election itself. In normal times, most Americans would probably prefer to exercise their franchise in person on election Day. However, a recent Pew Research Institute poll[1] showed that this time around, presumably due to the pandemic, only 40% of voters would prefer to do so with 39% wishing to vote by mail and 18% wanting to vote early in person.

The failure of the parties in Washington to agree on a further relief package would increase economic distress, likely worsen the pandemic and could even undermine perceptions of the democratic process in the United States. As such, it represents a broad threat both to U.S. stocks and the dollar. Because of the investment implications of the Washington stalemate, investors may want to increase their allocation to overseas assets. Because of the human consequences, they may want to urge both sides to come to an agreement soon.

Weekly Market Recap

Inflation has firmed recently, with core CPI rising 0.6% in July, the strongest m/m increase since 1991. The recent upswing in momentum and expectations for further fiscal stimulus has caused investors to consider higher inflation as a potential near-term risk. However, in our view, core inflation is unlikely to spike, at least in the near-term. Reflecting the offsetting impacts of the pandemic and fiscal stimulus, real consumer spending on goods rose 6% y/y in June, while services consumption fell by 12%. It should also be noted that core services accounts for roughly 75% of the core CPI index. Core services inflation was still just 2.3% y/y in July after averaging 2.9% over the past two years pre-pandemic and, while core goods inflation has rebounded more strongly, a meaningful reacceleration in demand for core services is needed for overall core inflation to move higher. Moreover, as the economy navigates through a bumpy reopening process, services demand may be slow to recover as consumers continue to curtail their spending on air travel, restaurants, hotels and other services. For investors, a slow rebound in the demand for services should allow inflation to drift higher only gradually in the coming months. That being said, services could come back strongly after the distribution of a vaccine, which may complicate the Fed’s policy decisions in the second half of 2021.

Multi-Asset Solutions Weekly Strategy Report

An evaporation of liquidity in inflation markets seems to explain much of the sharp decline in market pricing of inflation into March, most notably in the U.S.; a return of liquidity has driven most of the subsequent rebound.

Some of the decline in long-term inflation pricing does owe to falling actual inflation expectations, which have since only partially recovered.

Inflation expectations should recover with further economic stabilization and progress toward COVID-19 vaccines. More significant upside in inflation expectations could result from increasingly expansive monetary and fiscal policy, especially as central banks effectively support government deficit spending.

Opportunities:

Community Café is Wednesday, September 2nd at 8:00am for 30 minutes. Topic will be on: “Social Security”

- Will live stream on Facebook Live anyone who is friends with me on Facebook or Click Here to Follow The Community Café Facebook Page

- Email invitations were sent to join on the Zoom.us platform

- Speakers, Mark Roberts; Affinity Asset Management

- Invitations will go out via email with a link to join on zoom.com, plus those who are friends with me on Facebook

Estate Planning Webinar on Tuesday September 1st at 6:00pm and Wednesday September 2nd at 12:00pm noon

- email Stacy at [email protected]

If you would like a copy of my 30 minute recording of Community Café on the topic of “Tax saving Strategies”, please contact Stacy and we can email it to you.

Are you over age 72? RMDs, can be re-invested back into your IRAs.

- If you previously took your annual RMD, and with the stimulus package CARES allowing RMDs in 2020 only to be skipped, you can put that money back into your IRA. Call us for more details.

Referral rewards program:

Reminders:

Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

Any service work you would like us to do for you, please email your request to us.

Please feel free to share this email with anyone you know, as the best way to battle stock market anxiety is education.

Thank you for your time in reading these updates.

Stay safe and stay healthy,

Mark Roberts