Investment Commentary –January 12, 2021

Year to Date Market Indices as of January 12, 2021

• Dow 31,085 (1.54%)

• S&P 3,801 (1.18%)

• NASDAQ 13,066 (1.37%)

• Gold $1,854 (2.74%)

• OIL $53.14 (2.85%)

• Barclay Bond Aggregate (-0.98%)

• Fed Funds Rate 0-0.25 (0-0.25)

Stocks seek direction as Big Tech slides

U.S. equity markets were little changed Tuesday as Big Tech and the major averages looked to get back on track following their first losing session in five.

The Dow Jones Industrial Average was flat while the S&P 500 and the Nasdaq Composite were down 0.18% and 0.03%, respectively. All three indexes slid off record highs on Monday, dragged lower by outsized losses in Big Tech.

Looking at stocks, Big Tech shares were looking to bounce back a day after investors dumped shares in response to the silencing of President Trump and other conservative voices. Twitter Inc. and Facebook Inc. saw outsized losses on Monday after banning Trump from their platforms.

Elsewhere, Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson died Tuesday at the age of 87 following a battle with non-Hodgkins lymphoma. Adelson bought Sands Hotel and Casino in Las Vegas in 1989 and helped transform the city into a top U.S. destination for conventions and exhibitions.

Zoom Video Communications Inc. announced a proposed $1.5 billion offering of common stock. All shares of the proposed offering will be sold by the company.

Meanwhile, financials remain in focus as investors look ahead to earnings reports due out on Friday from Citigroup Inc., JPMorgan Chase & Co. and Wells Fargo & Co.

Oil majors Exxon Mobil Corp. and Chevron Corp. gained as West Texas Intermediate crude oil rallied 72 cents to $52.97 per barrel. Elsewhere in the commodities space, gold fell $11.90 to $1,838.90 per ounce.

Around The Web

New year, similar story: Key market catalysts that played out in late 2020 extended into the first week of 2021, lifting the major U.S. indexes to gains of around 2% and pushing record levels higher. Expectations of further U.S. government stimulus also helped to lift markets following Senate runoff elections in Georgia.

Surging small caps: After posting a record-breaking quarterly gain of 31% in the just-completed fourth quarter, a small-cap benchmark, the Russell 2000 Index, extended its rally into the new year. The index jumped around 6%, with most of the weekly rise coming from Wednesday’s single-day jump of 4%.

Jobs setback: Friday’s monthly U.S. labor market report marked the first time since April 2020 that jobs have declined rather than increased. The government reported a drop of 140,000 jobs; most economists had been predicting a gain of around 50,000. The labor market has nearly 10 million fewer jobs than it did in February

Earnings upgrade: Wall Street analysts’ profit forecasts for the quarterly earnings season that opens this week have recently been rising. According to FactSet, projections of earnings by companies in the S&P 500 increased by 2.3% over the course of last year’s fourth quarter. 2020.

Dividend restoration: A growing number of U.S. companies that cut dividends in response to the pandemic’s impact began to restore those payment levels in the just-completed fourth quarter. Net dividend changes—factoring in decreases as well as increases—totaled $9.5 billion, compared with a decline of $2.3 billion in the third quarter of 2020, according to S&P Dow Jones Indices.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Friday: Retail sales, U.S. Census Bureau

Today in Stock Market History

1914: Henry Ford announces that he will share the Ford Motor Co.’s profits with its workers by raising wages from $2.34 for a nine-hour day to $5.00 for an eight-hour day. He hopes his own workers will be able to afford to buy their own Fords; within two years, Ford goes on to produce its 1,000,000th car.

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

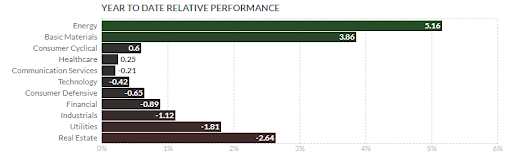

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.foxbusiness.com/markets/us-stocks-jan-12-2020