Investment Commentary – January 19, 2021

Year to Date Market Indices as of January 19, 2021

• Dow 30,932 (1.16%)

• S&P 3,797 (1.06%)

• NASDAQ 13,152 (2.05%)

• Gold $1,840 (2.74%)

• OIL $52.94 (9.33%)

• Barclay Bond Aggregate (-0.76%)

• Fed Funds Rate 0-0.25 (0-0.25)

Stocks climb as Yellen tells Congress to ‘act big’ on coronavirus stimulus

U.S. equity markets rallied Tuesday in President Trump’s final full day in office as traders weighed Treasury Secretary Nominee Janet Yellen’s Senate testimony on Capitol Hill.

The Dow Jones Industrial Average gained 119 points, or 0.39%, while the S&P 500 and the Nasdaq Composite advanced 0.59% and 0.8Yellen, the former Federal Reserve chair, will appear before the Senate Finance Committee Tuesday for her confirmation hearing.

Yellen will say Congress needs to “act big” to combat the economic slowdown caused by the COVID-19 pandemic, including extending more aid to families and providing additional money to expedite the distribution of vaccines.1%, respectively. The major averages were closed Monday in observance of Martin Luther King Jr. Day.

In stocks, Goldman Sachs Group reported strong quarterly results that were bolstered by continued strength in dealmaking and trading. Annual investment banking revenue hit a record while trading revenue was the strongest in a decade.

Bank of America reported a quarterly profit that exceeded estimates but revenue fell short. The firm’s board of directors announced a $3.2 billion share buyback plan.

Goldman Sachs boosts US economic outlook on Biden’s $1.9T stimulus plan

Goldman analysts lifted GDP forecast to 6.6% for 2021

Goldman Sachs analysts raised their growth forecasts for the U.S. this year after President-elect Joe Biden unveiled a sprawling coronavirus relief package that would inject $1.9 trillion into the nation’s sputtering economy.

In an analyst note to clients this weekend, economists led by Jan Hatzius projected the economy would grow 6.6% in 2021, faster than the 6.4% previously estimated. The economists said they expect the nation’s unemployment rate — which is at 6.7% — to fall to 4.5% by the end of the year, down from the prior estimate of 4.8%.

“We do not expect all of the elements of the $1.9 trillion proposal to pass, but we have raised our expectations for state fiscal aid, education and public health spending, unemployment insurance benefits, and several smaller items,” the analysts wrote.

Biden’s plan includes $20 billion to accelerate vaccine distribution, a $15-an-hour minimum wage, an extension of supplemental unemployment benefits through the end of September, a one-time $1,400 stimulus check and a one-year expansion of the Earned Income Tax Credit and Child Tax Credit.

“During this pandemic, millions of Americans, through no fault of their own, have lost the dignity and respect that comes with a job and a paycheck,” Biden said last week during a prime-time address. “There is real pain overwhelming the real economy.”

Close to 400,000 people in the U.S. have died of COVID-19 and more than 24.1 million have been infected, the most in the world. Lockdown measures adopted across the country to curb the spread of the virus have cost millions of Americans their jobs.

The Goldman economists said they expect the additional $1,400 direct cash payment will cause a “large spike” in disposable income in the first three months. Bank analysts previously upped their estimate for the amount of stimulus Biden will secure to $1.1 trillion, an increase from the previous estimate of $750 billion.

Democrats will control the Senate by the thinnest of margins after twin victories by Jon Ossoff and Raphael Warnock in the Georgia runoff elections last week clinched the party a 50-50 split in the upper chamber, with Vice President-elect Kamala Harris able to cast a tie-breaking vote. Democrats hold a slim 222-to-211 advantage in the House.

Even with a monopoly on power, however, Biden could have a difficult time getting the aid package passed: Unless the Senate uses a tool known as “reconciliation” that requires only a majority vote — which Biden has signaled he doesn’t support — then the legislation will need 10 GOP votes in order to pass.

Around The Web

Earnings launch: With quarterly earnings season just starting, Wall Street analysts expect companies in the S&P 500 to report a 6.8% decline in net income compared with the prior year’s fourth quarter, according to FactSet. Of the 26 companies that had reported as of Friday, all but one exceeded expectations.

Small-cap momentum: For the third week in a row, small caps outperformed as the Russell 2000 Index, a small-cap benchmark, posted a modest gain while large-cap indexes declined. Since the end of September 2020, the Russell 2000 has surged 41%.

Bitcoin’s stumble: Bitcoin’s rise above the $40,000 price threshold was short-lived. After eclipsing that record level at the end of the previous week, the cryptocurrency plunged below $32,000 at one point on Monday. By Friday, bitcoin was trading for around $35,000.

Stimulus proposal: In advance of Wednesday’s scheduled inauguration in Washington, President-elect Joe Biden announced a proposed $1.9 trillion coronavirus relief and economic stimulus package. In addition to more money for COVID-19 testing and vaccine distribution, the proposal calls for $1,400-per-person direct payments to most U.S. households.

Upcoming Events

Wednesday: Inauguration of Biden administration

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History

1999: Pres. Bill Clinton proposes, in his State of the Union address, “investing a small portion [of the Social Security trust fund] in the private sector just as any private or state government pension would do. This will earn a higher return and keep Social Security sound for 55 years.” Democrats shrug, but when Pres. George W. Bush revives the proposal four years later, they claim it is irresponsible.

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

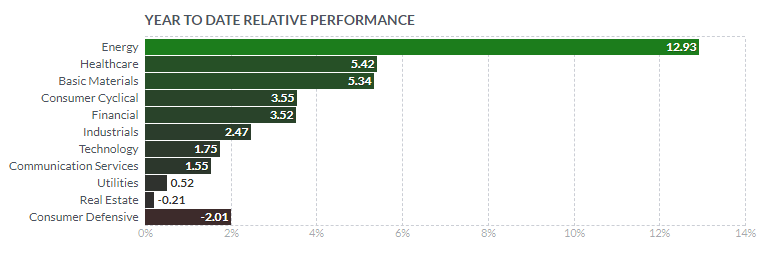

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.foxbusiness.com/markets/us-stocks-jan-19-2021

https://www.foxbusiness.com/economy/goldman-sachs-boosts-us-economic-outlook-bidens-stimulus-plan