Investment Commentary – Jun 15, 2021

Year to Date Market Indices as of June 15, 2021

• Dow 34,300 (13.07%)

• S&P 4,248 (14.63%)

• NASDAQ 14,111 (9.65%)

• Gold $1,870 (-0.09%)

• Oil $66.06 (36.29%)

• Barclay Bond Aggregate (-2.85%)

• Fed Funds Rate 0-0.25 (0-0.25)

Here are 7 reasons to stay bullish on stocks and why the S&P is headed to 4,600, from Credit Suisse

Investors continued to sweep away those inflation worries at the start of the week, sending the S&P 500 SPX, -0.11% and the Nasdaq Composite COMP, -0.25% to fresh highs. That’s a decent feat for the latter, which last hit a record on April 26.

Markets simply believe it is too soon for a Federal Reserve taper, as the central bank’s two-day meeting kicks off Tuesday. According to Bank of America’s latest monthly fund manager survey, 72% are buying the Fed’s line that inflation is transitory.

That doesn’t mean some investors aren’t still worried about this, that and the other. Our call of the day comes from Credit Suisse’s chief U.S. equity strategist Jonathan Golub, who offers reasons to stay bullish.

“Surprisingly, we find investors more bearish as inflation readings and declining yields dominate conversations,” he said in a note to clients that published on Monday. “Despite these issues, we remain comfortable with our 4600 [S&P 500 SPX, -0.11% ] year-end price target, which implies 8.3% upside.”

So here’s Golub debunking a few current investor concerns (in bold), with charts to back it up:

Inflation readings such as last week’s on consumer prices and higher commodity prices could begin putting profit margins under pressure. “Our work indicates that companies are experiencing substantial pricing power which should lead to greater profitability despite higher input costs,” countered Golub.

Some Fed officials have hinted of a readiness to start discussing tapering asset purchases, while rate-hike expectations have inched forward. In a review of rate increase cycles in 1994, 1999, 2004 and 2015, the bank found that returns were robust 12 months ahead of, and 36 months after the first rate increase, weakening only when the yield curve flattens.

Signs of declining bond yields in the face of higher prices could mean stagflation is looming. That is unlikely, with inflation largely seen as transitory and 10-year Treasury yield rate declines modest (5-year range 0.5% to 3.2%), said Golub.

Economic surprises have steadily fallen since mid-July, but the market keeps going up. Economic activity has improved during this time, and that is the “true catalyst of the S&P 500’s advance,” the strategist argued.

Growth and earnings per share, both running high, could be about to roll over. “While the pace of improvement is sure to moderate, growth is projected to remain well above trend through the end of 2022,” said the strategist.

While fiscal and monetary policy kept economies running throughout the COVID-19 pandemic, further help looks unlikely. “While further stimulus appears less likely (or will be reduced), we are less concerned given (1) an overheating economy; (2) less immediate impact of plan; and (3) higher accompanying taxes,” said Golub.

Retail sales and a 17-year tariff squabble may be over

- A 17-year trade spat between the U.S. and the European Union over aircraft subsidies for rival manufacturers Boeing BA, +0.29% and Airbus AIR, +0.34% is reportedly close to being resolved. Shares of both are up.

- Hong Kong officials are on the alert for a possible leak at Taishan Nuclear Power Plant in Guangdong province. Those reports knocked Hong Kong stocks.

News Around The web:

Bond rally

Prices of U.S. government bonds surged, pushing yields down to the lowest levels in more than three months. The yield of the 10-year U.S. Treasury bond fell below 1.50% on Wednesday, and on Friday it slipped as low as 1.45%. As recently as March 31, the yield had been at 1.74%.

Fed ahead

Inflation concerns could be top of mind for many U.S. Federal Reserve officials as policymakers hold a two-day meeting scheduled to end on Wednesday. While the Fed is expected to keep its benchmark interest rate unchanged—and at a near-zero level—the recent spike in consumer prices could spur discussion of other steps to tighten monetary policy.

Recovery indicators

On Thursday, the latest weekly report showed that new claims for unemployment benefits fell to 376,000, the lowest level recorded since the pandemic hit. On Friday, an index of consumer sentiment rose more than expected as survey participants grew more optimistic about future economic growth and employment.

THIS DAY IN FINANCIAL HISTORY

1995: Less than a year-and-a-half after breaking the 800 barrier, the NASDAQ Composite Index closes above 900 for the first time, finishing the day at 902.68.

Views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.marketwatch.com/story/7-reasons-to-stay-bullish-on-stocks-and-why-the-s-p-is-headed-to-4-600-from-credit-suisse-11623755087?mod=home-page

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

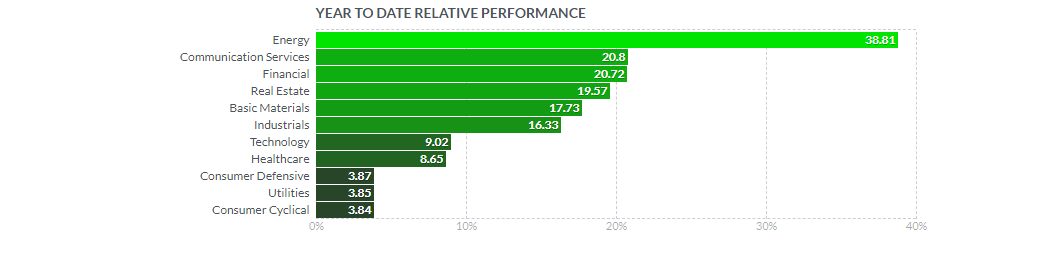

https://finviz.com/groups.ashx (YTD Performance Chart)