Hello again,

Happy 4th of July to all of us and America. Due to Coronavirus, I have only seen my parents once since this started. And this weekend, we finally get to go see them at their home in Lake of the Ozarks for the first time of 2020.

There are some very big announcements and information in this email below. Tidbits #1 and #2 and Opportunities #1…(be sure to read these 3 sections)

No Teleconference this Wednesday 7/1/20

Performance DJIA:

Mon 6/22 +0.59%

Tues 6/23 +0.50%

Wed 6/24 -2.72%

Thurs 6/25 +1.18%

Fri 6/26 -2.84%

Last week -3.31%

Since 2/19 market high -14.79%

Bond model you are in:

Last week -0.06%

Comparison:

Bond model last 30 days +1.65%

Tid Bits:

1. IF YOU ARE OVER 72 or know of someone who is over 72, this applies to you. RMDs. Remember that 2020 RMDs are waived due to the CARES stimulus package? If you are age 72 and older, you typically have Required Minimum Distributions (RMDs), to take and pay income taxes on that distribution. We have recently discovered some latest news on the CARES package. Basically if you took your withdrawal, you can put that money back into your accounts. Couple ways to do this, see below. If you took a withdrawal and had income taxes withheld, that can’t be fixed until you do your 2020 tax return, then you can get a refund then. Thinking outside the box…you can pay that back from an outside source like your bank account, or taking a withdrawal from your Non-IRA investment account to pay it back, thus not being taxed at full federal and state income taxes. If you can save on income taxes this way, and use this one year for an extra Roth IRA conversion, BONUS!!!

a. R-2020-127, June 23, 2020 WASHINGTON —

b. The Internal Revenue Service today announced that anyone who already took a required minimum distribution (RMD) in 2020 from certain retirement accounts now has the opportunity to roll those funds back into a retirement account following the CARES Act RMD waiver for 2020.

c. The 60-day rollover period for any RMDs already taken this year has been extended to August 31, 2020, to give taxpayers time to take advantage of this opportunity.

d. The IRS described this change in Notice 2020-51 (PDF), released today. The Notice also answers questions regarding the waiver of RMDs for 2020 under the Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act.

e. The CARES Act enabled any taxpayer with an RMD due in 2020 from a defined-contribution retirement plan, including a 401(k) or 403(b) plan, or an IRA, to skip those RMDs this year. This includes anyone who turned age 70 1/2 in 2019 and would have had to take the first RMD by April 1, 2020. This waiver does not apply to defined-benefit plans.

f. In addition to the rollover opportunity, an IRA owner or beneficiary who has already received a distribution from an IRA of an amount that would have been an RMD in 2020 can repay the distribution to the IRA by August 31, 2020.

g. The notice provides that this repayment is not subject to the one rollover per 12-month period limitation and the restriction on rollovers for inherited IRAs. The notice provides two sample amendments that employers may adopt to give plan participants and beneficiaries whose RMDs are waived a choice as to whether or not to receive the waived RMD. IRS announces rollover relief for required minimum distributions from retirement accounts that were waived under the CARES Act

2. Affinity Asset Management is making strategic adjustments in light of new information. Yes, there is still lots of fear of what all the Recession and economic backlash will be. However, we have seen with the stimulus package (CARES), that has held the market together, allowing some growth and lessened the volatility. The stimulus package is pushing these enviable problems down the road to be handled later. President Trump has announced a 3rd round of stimulus. It is not known yet, how big, when, or what/who it will benefit, but stimulus is still stimulus. From a political strategy, President Trump wants to do all he can to make sure he gets re-elected. States all over are reporting Covid-19 increasing once again. Yet the market isn’t being affected too much. Economists have said if round two of Covid-19 comes back, there is likely NOT going to be another stay-at-home order. The market hasn’t recovered all from its February 19th high, but recovered most of it. And with the pending round 3 of stimulus, Affinity Asset Management has made plans to get bought back in incrementally. Market drops, we buy in a little. It drops a little more, we buy in a little more. The concept of “cycle trading” is not gone, just pushed back while stimulus money keeps the market up. Until the market shows a ww shape, cycle trading is not possible. It will become possible, just farther down the road and likely past the election.

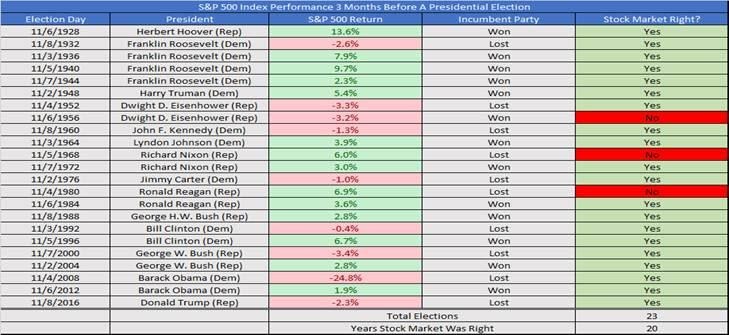

3. S&P 500 Index Performance 3 Months Before A Presidential Election: If the S&P 500 is green the three months before the election, the incumbent party tends to stay in the White House. If stocks are down, though (like they were in 2016), this potentially could signal a change in power in the White House. The track record isn’t perfect, but in 20 out of the past 23 elections, stocks have been correct. Next week’s Monday email will have some neat charts on election results and the connection to the stock market.

Facts:

1) Coronavirus

a) Global 10,279,655 cases 505,139 deaths

b) US 2,637,439 cases 128,443 deaths (+5.06%, 6,184 increase from last week)

c) KS 13,891 cases 271 deaths

d) MO 21,201 cases 1,023 deaths

Highlights from analysts and economists

1. From BNY Mellon

a. The economic challenge currently faced by companies is immense and may be greater than at any time since World War II. Many firms have switched from maximizing shareholder value through share buybacks and dividends, to focus on keeping their businesses alive as they react to significant drops in cash flow. In our view, not all companies will be successful in doing so. For investors, the collapse in dividend pay-outs could refocus their attention on bond income, which is contractual and possibly more stable. The economic uncertainty has raised the potential for bond downgrades and defaults, but has raised the yield available on a broad universe of corporate bonds, thereby improving the income stream. Another element of behavioral change is the potential for companies and investors to have a higher level of savings in the future to combat the uncertainty as the Covid-19 coronavirus takes time to dissipate.

2. From JP Morgan

a. Notes on the week ahead

i. In time, the U.S. dollar should fall, both because of the trade deficit and because the gap between U.S. and other developed country interest rates has fallen. Corporate tax rates may well rise in the years ahead as the federal government attempts to narrow its yawning budget deficit. A more effective overseas response in squashing Covid-19 would also seem to favor international stocks. Finally, there seems no logical reason, based on long-term growth prospects, sectoral composition or local interest rates for investors to be willing to pay what is, in effect, a 36% premium for a made-in-the USA label on stocks.

ii. Yet those betting on international stocks, value stocks and higher real interest rates may have to wait for some catalyst to move relative pricing closer to, rather than farther away from, fair value. Timing this switch is very difficult. However, it is worth reflecting on what has short-circuited the natural gravitational pull of fair value in recent years.

iii. I believe it may ultimately have its roots in the flood of resources that have been directed towards financial assets in recent years. An aging population saving for retirement, growing inequality, lower taxes on dividends and capital gains, and extraordinary monetary ease have all fueled a very steady rise in the value of financial assets relative to GDP. When asset prices are broadly rising, investors are generally more willing to take risks. This potentially could make them more willing to invest in growth stocks and long-duration bonds. In addition, to the extent that U.S. investors have seen rising markets and international investors have been seeing less positive results, more money may have simply been allocated to what has worked recently.

iv. If this is the case, the most obvious catalyst would simply be a switch to a period of outflows from financial assets. If, for a period of time, because of the retirement of the Baby Boom, higher taxes or attempts to reduce inequality, resources are drained from financial markets, investors may focus much more on the fundamentals that underpin the value of assets rather than what had done well in an exuberant market. This could lead to a substantial correction not just in absolute valuations but in relative valuations.

b. Weekly market recap

i. Last week, the IMF released an update on its World Economic Outlook in which it downgraded 2020 global growth to -4.9%, the largest contraction since 1946. This change reflects a worse than expected impact from COVID-19 in the first half of this year, and a slower recovery in the second half than previously projected. The report attributes the deeper downturn to weaker consumption due to lockdowns and steep income losses, as well as subdued investment amid a highly uncertain environment.

ii. However, it noted that sizeable fiscal and monetary stimulus around the world has partially offset the damage. Still, for the first time, all regions are likely to experience negative growth this year, although to varying degrees. In economies where infection rates are declining, an early recovery is expected, although it may drag on due to continuing social distancing and reduced productivity as businesses operate with health precautions in place. As for countries that are still struggling to control the virus, more severe social distancing measures will weigh further on economic activity.

iii. The IMF also revised down global growth for 2021 by -0.4% to 5.4%. Although this is slower than previously forecast, this should be the fastest growth since 1964. While global economic growth should be slow for the rest of this year, it is expected to surge in 2021 and investors should start asking whether they are positioned for an eventual global economic recovery.

Opportunities:

Community Café is Wednesday, July 1st th at 8:00am for 30 minutes. Topic will be: “Want more money & less taxes in retirement?”

- Will live stream on Facebook Live anyone who is friends with me on Facebook.

- Email invitations were sent to join on the Zoom.com platform

- Mark Roberts with Affinity Asset Management speaking.

- Invitations will go out via email with a link to join on zoom.com, plus those who are friends with me on Facebook

Estate Planning webinar on Tuesday, June 30rd at 12:00 noon for 1 hour.

- Pros and cons of a Will based estate plan

- Pros and cons of a Trust based estate plan

- Co-hosted by Glenn Stockton with Stockton & Stern Law firm

- Interested in attending? Please email Stacy at [email protected]

If you are still working, call your 401K company, (not your HR department of your employer) and ask if you have access to an “in-service rollover”. And if you do, let us know ASAP as there are potential large benefits that you don’t have at work in that 401K.

Reminders:

- Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

- Any service work you would like us to do for you, please email your request to us.

Please feel free to share this email and/or the teleconference information with anyone you know as the best way to battle stock market anxiety is education.

Thank you for your time in reading these updates.

Stay safe and stay healthy,