Investment Commentary – March 31, 2021

Year to Date Market Indices as of March 31, 2021

• Dow 33,171 (8.38%)

• S&P 3,971 (5.72%)

• NASDAQ 13,059 (1.33%)

• Gold $1,709 (-10.12%)

• OIL $61.65 (27.26%)

• Barclay Bond Aggregate (-3.71%)

• Fed Funds Rate 0-0.25 (0-0.25)

Rueters Market News: Dollar gains as investors bet on strong U.S. recovery

NEW YORK (Reuters) – The dollar advanced against major currencies on Tuesday, climbing to a one-year high versus the yen, as increasing U.S. vaccinations and a major stimulus package backed expectations of a strong recovery from the pandemic, lifting Treasury yields.

Benchmark 10-year Treasury yields rose to 14-month highs on Tuesday at 1.776%, and were last slightly up on the day at 1.727%.

Treasury yields hit new highs a day before President Joe Biden is set to outline how he intends to pay for a $3 trillion to $4 trillion infrastructure plan.

The dollar index rose above the 93 mark and was last up 0.4%at 93.294. It hit a high of 93.357, its highest level in four months.

“U.S. economic optimism has been the biggest driver this whole time with the move from 89 in the dollar index to 93,” said Erik Nelson, macro strategist at Wells Fargo in New York.

“There is a bit of momentum behind the move. We have broken some key technical levels in some of the key currencies, including the dollar index,” he added.

The dollar index has risen in five of the last six sessions.

Tuesday’s U.S. data further supported the upbeat outlook on the world’s largest economy. Reports showed that U.S. consumer confidence climbed in March to its highest level since the start of the COVID-19 pandemic, while housing prices soared year-on-year in January.

The safe-haven dollar also found some support as investors digested the fallout from the collapse of highly leveraged investment fund Archegos Capital.

The greenback also rose above 110 yen, a level not seen since March last year, and was last up 0.5% on the day at 110.35 yen. The greenback was on track for its best month since late 2016.

Around the Web

Meandering market: The S&P 500 and the Dow both gained around 1.5% for the week as a late Friday surge put the indexes within reach of breaking out from the tight range that they’ve been in since mid-February. Stocks have been largely stuck in place amid optimism for the economic recovery offset by concerns about rising bond yields.

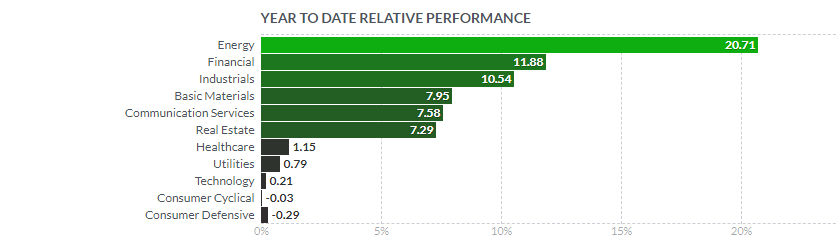

Value’s comeback: The margin in the latest week was slim, but U.S. large-cap value stocks outperformed growth stocks for the seventh week in a row. During that span, a value stock benchmark has risen about 7% while a growth benchmark has dropped around 4%.

Labor market improvement: The number of unemployment benefit claims fell sharply in the latest week to 684,000—the lowest figure since the pandemic sent unemployment levels soaring. Looking ahead, a monthly jobs report is scheduled to be released on Friday; the most recent report showed a gain of 379,000 jobs in February.

Positive outlook: Ahead of the mid-April start of quarterly earnings season, nearly twice as many companies that have issued guidance prior to their earnings releases raised their expectations compared with the number that lowered their forecasts. Sixty companies in the S&P 500 had issued positive guidance as of Friday, while 34 had issued negative guidance, according to FactSet.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History:

1999: Less than a year after breaking the 9,000 mark, the Dow Jones Industrial Average closes above 10,000 for the first time, as it finishes the day at 10006.78.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.reuters.com/article/global-forex/forex-dollar-gains-as-investors-bet-on-strong-u-s-recovery-idUSL1N2LS1MM

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.