Investment Commentary – May 14, 2019

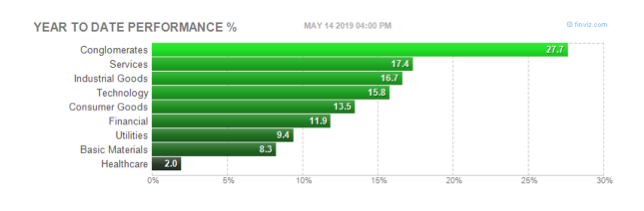

Year to Date Market Indices as of Market Close May 14, 2019

Dow 25,532 (9.45%)

S&P 2,834 (13.07%)

NASDAQ 7,734 (16.57%)

Gold $1,297 (0.02%)

OIL $61.71 (5.99%)

Barclay Bond Aggregate (3.46%)

All World Index (10.10%)

Stocks close higher as market regains bullish form in wake of trade-sparked rout

U.S. stocks closed higher Tuesday as the market regained some of its bullish form, a day after a sharp escalation in U.S.-China trade tensions triggered the worst session for major indexes since early January.

How did the benchmark indexes fare?

The Dow Jones Industrial Average DJIA, +0.82% added 207.06 points, or 0.8%, to 25,532.05. The S&P 500 index SPX, +0.80% rose 22.54 points, or 0.8%, to 2,834.41, and the Nasdaq Composite Index COMP, +1.14% gained 87.47 points, or 1.1%, to 7,734.49.

What drove the market?

The start of the week was marked by a ramp-up in trade tensions after China fired back at U.S. tariffs with retaliatory duties that could reach 25% on $60 billion in annual U.S. exports. That was after the U.S. last week raised tariffs on $200 billion in annual Chinese imports to 25% from 10%, and threatened more following talks that ended Friday without a deal between the two countries.

Investors are worried that an escalating fight between the two could harm the U.S., Chinese and global economies.

But some calm appeared to have been restored after President Donald Trump said late Monday that it should be clear in “three or four weeks” if a U.S. delegation’s recent trip to China to discuss trade was successful. “I have a feeling it’s going to be very successful,” he added.

Tuesday morning, the president took to Twitter to defend his trade strategy and mollify U.S. farmers, whose exports have collapsed amid the dispute, writing that: “When the time is right, we will make a deal with China. My respect and friendship with President Xi is unlimited but, as I have told him many times before, this must be a great deal for the United States or it just doesn’t make any sense.”

Around the Web:

Deal or no deal?: The week’s volatility was triggered by dashed expectations that the United States and China were on the verge of concluding a trade deal. The United States accused China of backtracking on earlier commitments, leading the Trump administration to increase tariffs on nearly half of Chinese imports from 10% to 25%. The latest talks concluded on Friday without a deal.

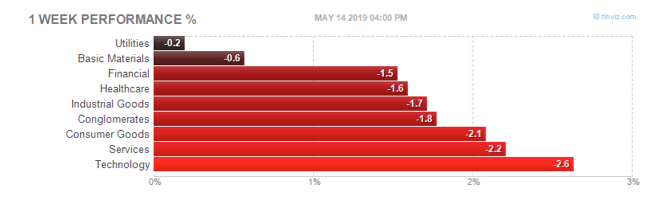

Volatility’s return: A gauge of investors’ expectations of short-term stock market volatility jumped 24% for the week, breaking out of the narrow range that it had been stuck in over the previous three months. The Cboe Volatility Index closed on Friday at 16 after reaching as high as 23 in intraday trading on Thursday.

Inflation subdued: A key measure of U.S. inflation rose less than economists had expected, despite recent strength in the labor market and GDP growth. Excluding volatile food and energy costs, the Consumer Price Index rose 2.1% in April compared with the same month a year earlier and just 0.1% relative to March’s figure.

Upcoming events:

Friday: The Conference Board Leading Economic Index for the U.S.

Other Notable Indices (YTD)

Russell 2000 (small caps) 13.45

EAFE International 9.10

EAFE Emerging Markets 5.25

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/story/us-stock-futures-point-to-bounce-on-heels-of-trade-related-selloff-2019-05-14?mod=mw_theo_homepage&mod=mw_theo_homepage

https://finviz.com/groups.ashx