Investment Commentary – May 28, 2019

Year to Date Market Indices as of Market Close May 28, 2019

Dow 25,347 (9.45%)

S&P 2,802 (13.07%)

NASDAQ 7,607 (16.57%)

Gold $1,279 (0.02%)

OIL $58.97 (5.99%)

Barclay Bond Aggregate (3.46%)

All World Index (9.66%)

Stocks close near intraday lows as investors seek fresh market catalysts

U.S. stocks closed near intraday lows Tuesday after major benchmarks surrendered earlier gains as investors sought new catalysts after a long holiday weekend while monitoring U.S.-China trade tensions.

How did major benchmarks fare?

The Dow Jones Industrial Average DJIA, -0.93% shed 237.92 points, or 0.9%, to 25,347.77, while the S&P 500 index SPX, -0.84% fell 23.67 points, or 0.8%, to 2,802.39. The Nasdaq Composite Index COMP, -0.39% dropped 29.66 points, or 0.4%, to 7,607.35.

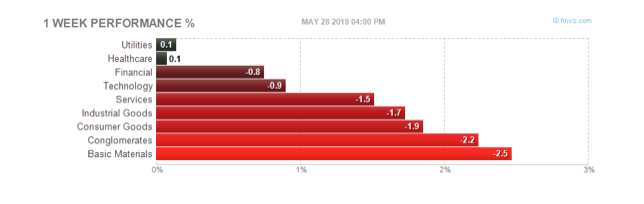

U.S. financial markets were closed Monday for Memorial Day. Stocks ended higher Friday but booked losses for the week, extending the Dow’s weekly losing streak to five, its longest since June 2011. The Dow saw a 0.7% weekly fall, while the S&P 500 logged a 1.2% retreat and the Nasdaq Composite gave up 2.3%.

What drove the market?

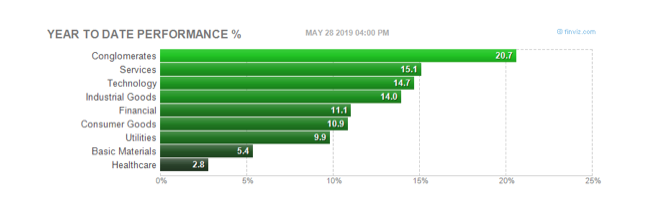

The major indexes remain solidly higher for the year to date but have retreated significantly in May as U.S.-China trade tensions have heated up. Washington and Beijing have engaged in a round of tit-for-tat tariff escalations, while the Trump administration has moved to blacklist U.S. exports to Chinese telecom-equipment firm Huawei Technologies Co., prompting threats of further retaliation by China.

President Donald Trump, speaking at a joint news conference Monday in Tokyo with Japanese Prime Minister Shinzo Abe, said the U.S. wasn’t ready to make a trade deal with China.

“They (China) would like to make a deal. We’re not ready to make a deal,” Trump said, according to Bloomberg. He added that tariffs on Chinese products could go up “very substantially.”

Home prices rose in March by 0.1% compared with February and 2.7% compared with last year, according to the S&P CoreLogic Case-Shiller 20-city index. That is the slowest annual pace of growth since August 2012.

Consumer confidence improved in May, according to the Conference Board’s index, which rose to 134.1 from 129.2 in April, above economists expectations of a 132.0 reading, per a MarketWatch poll.

Around the Web:

May’s pain: It’s been a rough ride for stocks since the start of May, when the major indexes were at or near record highs. With a week left in May, the S&P 500 and Dow were down around 4% while the NASDAQ was nearly 6% lower.\

Brexit casualty: U.K. Prime Minister Theresa May on Friday announced plans to resign on June 7 without completing the Brexit process, creating more uncertainty as the United Kingdom struggles to agree on terms of its pending divorce from the European Union. In currency markets, the British pound rose on Friday, breaking a string of daily losses.

Bitcoin’s resurgence: Bitcoin climbed nearly 10% for the week, extending a rally that’s seen the cryptocurrency nearly double in value since the end of March. However, at around $8,050 on Friday, bitcoin still has plenty of ground to make up after a difficult 2018, when it started the year above $13,800 but finished below $3,800.

Upcoming events:

Thursday: First-quarter GDP, second estimate.

Other Notable Indices (YTD)

Russell 2000 (small caps) 12.85

EAFE International 9.83

Emerging Markets 2.42

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/story/stock-index-futures-edge-lower-as-trade-worries-hang-over-market-2019-05-28?mod=mw_quote_news