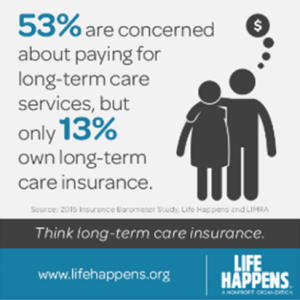

Given that the cost of long-term care can quickly deplete your life’s savings, you should seriously consider adding long-term care insurance to your financial plan. Plus, there’s about a 70% chance you’ll need some type of long-term care after age 65.

Should you ever require it, a home health aide visit costs about $19 an hour, while full-time nursing home care in a private room, the most expensive type of care, now has a median cost $84,000 a year. In some regions of the country, like the Northeast, the cost may be well above that amount. Financial considerations cannot be understated, long-term care insurance is also about mind and control. Having it ensures you’ll have access to first-rate care when you need it, and that you won’t have to be dependent on others or be a burden to your children. The odds you’ll need long-term care insurance are greater than you might imagine.

Should you ever require it, a home health aide visit costs about $19 an hour, while full-time nursing home care in a private room, the most expensive type of care, now has a median cost $84,000 a year. In some regions of the country, like the Northeast, the cost may be well above that amount. Financial considerations cannot be understated, long-term care insurance is also about mind and control. Having it ensures you’ll have access to first-rate care when you need it, and that you won’t have to be dependent on others or be a burden to your children. The odds you’ll need long-term care insurance are greater than you might imagine.

Long-term care services are not just for older people: Anyone who’s has been in an accident or suffers from a debilitating illness may also require round the clock care. In fact, 40% of patients receiving long-term care are under age 65.you can afford to pay for care without significantly impacting your assets, you may not need long-term care insurance.

Conversely, if your assets, not including your home, are less than $80,000 if you’re married, or $30,000 if you’re single, you may not be able to afford the premiums. But If you’re somewhere in between, long-term care insurance should be part of the discussion the next time you sit down with an advisor to review your financial plans.

For a free booklet “What you need to know about long-term care insurance” or request an appointment with our Long-term Care specialist please send an email to Kate in our office at [email protected] give her a call at (913) 381-4800.

Leave A Comment